Accept applications and execute leases completely online with RentCafe. We were able to set up…

Preparing simple consolidated financial statements F3 Financial Accounting ACCA Qualification Students

This enforceable decision should not have a material impact on the Group’s 2024 financial statements. Prepare the consolidated income statement to incorporate P and S for the year ended 31 March 20X9. Prepare the consolidated income statement to incorporate P and S for the year ended 31 December 20X9. From revenue to profit for the year include all of P’s income andexpenses plus all of S’s income and expenses (reflecting control ofS), subject to adjustments (see below). To better illustrate the specific components of OCI, let’s look at a statement from MetLife.

IFRS requirements

However, when the parent has a non-majority ownership stake in the subsidiary, or cannot exert significant influence over its operations, then it uses other consolidation methods like the cost and equity methods. The consolidated statement of cash flows (consolidated statement of changes in funds) shows cash inflows and outflows for an entity and its subsidiaries. For majority-owned subsidiaries (over 50% ownership), their cash flows are fully consolidated into the parent’s statement.

How to Interpret the Statement of Comprehensive Income (with Examples)?

This report should include the consolidated income statement, balance sheet, and cash flow statement. The goal is to present an accurate and comprehensive picture of the company’s overall financial standing. These reports include key documents such as the consolidated income statement, balance sheet, and cash flow statement, which provide an overall view of liabilities, assets, cash flow, and more. The goal is to provide stakeholders with a clear understanding of how the company is performing as a whole, including any subsidiaries or related entities.

Essential components of consolidated financial statements

The OCI measure was also quite helpful during the financial crisis of 2007 to 2009 and through its recovery. For instance, coming out of the Great Recession, the banking giant Bank of America reported a $1.4 billion profit on its standard income statement, but a loss of $3.9 billion based on comprehensive income. The difference had to do with OCI and the unrealized losses that took place in its investment portfolio. Overall, it called into question the quality of the profit figures it held out as its real measure of capital generation for the year. A company’s statement of profit and loss, also known as its income statement, has its drawbacks.

Notes to Financial Statements

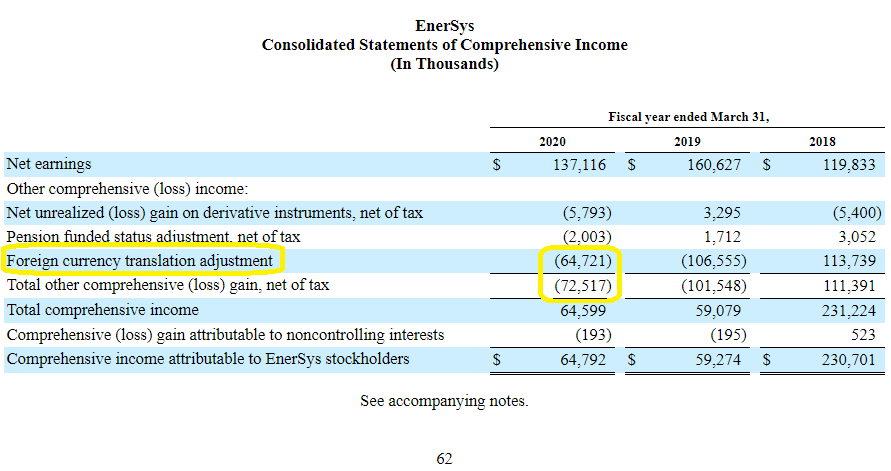

Its ownership stake in publicly traded company Kraft Heinz (KHC) is accounted for through the equity method. A consolidated income statement, also known as the consolidated statement of operations and comprehensive income, aggregates the income of a parent company along with its subsidiaries. When a parent company owns at least 51% of a subsidiary, all the subsidiary’s revenue, expenses, and income are rolled into the parent’s consolidated income statement. A statement of comprehensive income, which covers the same period as the income statement, reflects net income as well as other comprehensive income, the latter being unrealized gains and losses on assets that aren’t shown on the income statement. The statement of comprehensive income gives company management and investors a fuller, more accurate idea of income.

Colgate Gains (losses) on cash flow hedges included in other comprehensive income are $7 million (pre-tax) and $5 million (post-tax). This is especially true of public companies and private companies that issue financial instruments in a public market—though this depends on the jurisdiction consolidated statements of comprehensive income the company operates in. In these situations, producing financial statements is important for remaining compliant with regulatory requirements. In some circumstances, companies combine the income statement and statement of comprehensive income, or it will be included as footnotes.

- Indeed, their sales are made up of electrical and digital building infrastructure products in particular to electrical installers, sold mainly through third-party distributors.

- Another suggestion is that the OCI should be restricted, should adopt a narrow approach.

- Because the parent company and its subsidiaries form one economic entity, investors, regulators, and customers find consolidated financial statements helpful in gauging the overall position of the entire entity.

- Typically, this will involve calculating the figures for a consolidated statement of profit or loss or a consolidated statement of financial position.

In the past, changes to a company’s profits that were deemed to be outside of its core operations or overly volatile were allowed to flow through to shareholders’ equity. Consolidated financial statements typically consist of the following key components, each providing essential information for assessing the financial health and performance of a group of companies. The number of disclosures necessary for a financial statement will depend on the exact statement being produced and the jurisdiction each entity operates under.

When a financial statement reports the amounts for the current year and for one or two additional years, the financial statement is referred to as a comparative financial statement. For example, the income statement of a large corporation with its shares of stock traded on a stock exchange might have as its heading “Consolidated Statements of Income” and will report the amounts for 2023, 2022, and 2021. This allows the user to compare sales that occurred in 2023 to the sales that occurred in 2022 and in 2021. Consolidated financial statements report a parent company’s financial health and include financial information from its subsidiaries. Like the list above, unrealized gains and losses from cash flow hedges flow through the Statement of comprehensive income.

However, a company with other comprehensive income will typically file this form separately. The statement of comprehensive income is not required if a company does not meet the criteria to classify income as comprehensive income. Always start by reading the question requirement carefully to determine what is being asked for. Here, in this specific OT question, it is the goodwill on acquisition that is being asked for, whereas other questions may ask, for example, for the cost of investment that would be recorded in the parent’s individual financial statements.

Intercompany transactions occur when entities within the group engage in transactions with each other. These transactions need to be eliminated or adjusted in the consolidation process to avoid double-counting or misrepresentation. The elimination of intercompany transactions ensures an accurate representation of the group’s financial position. It is essential to carefully analyze intercompany transactions and ensure they are appropriately recorded in the consolidated financial statements. Consolidated financial statements include the aggregated financial data for a parent company and its subsidiaries.